Complete the funding declaration form

Why?

- To comply with audit rules, the provider must meet the party face-to-face to sight evidence and sign the funding declaration form.

- You must keep a copy of the party’s proof of financial eligibility, as per the Ministry’s Operational Guidelines for suppliers of FDR services. For audit purposes, you need to keep copies of the form and supporting evidence for at least seven years.

- You should not send a copy of the form to the Ministry, but you must keep a copy on file.

How?

-

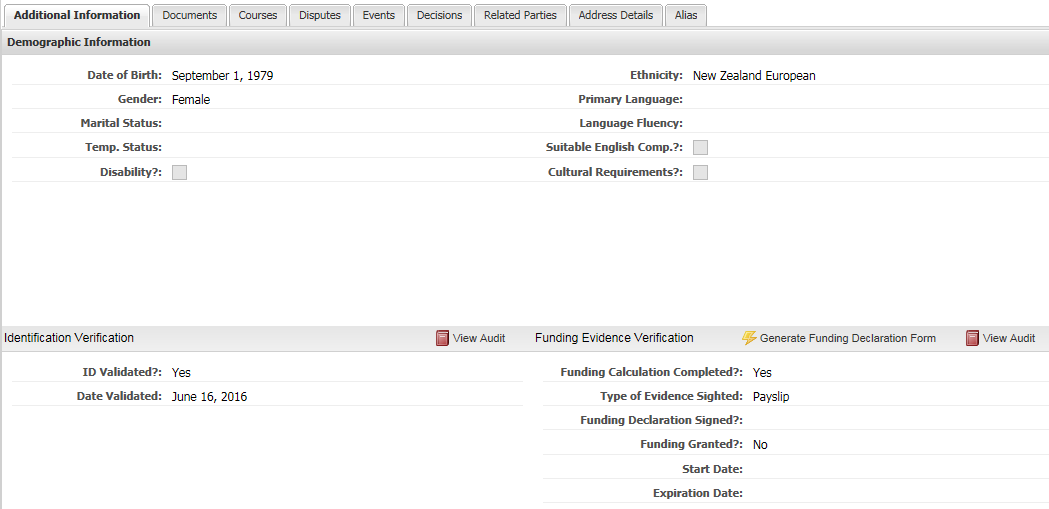

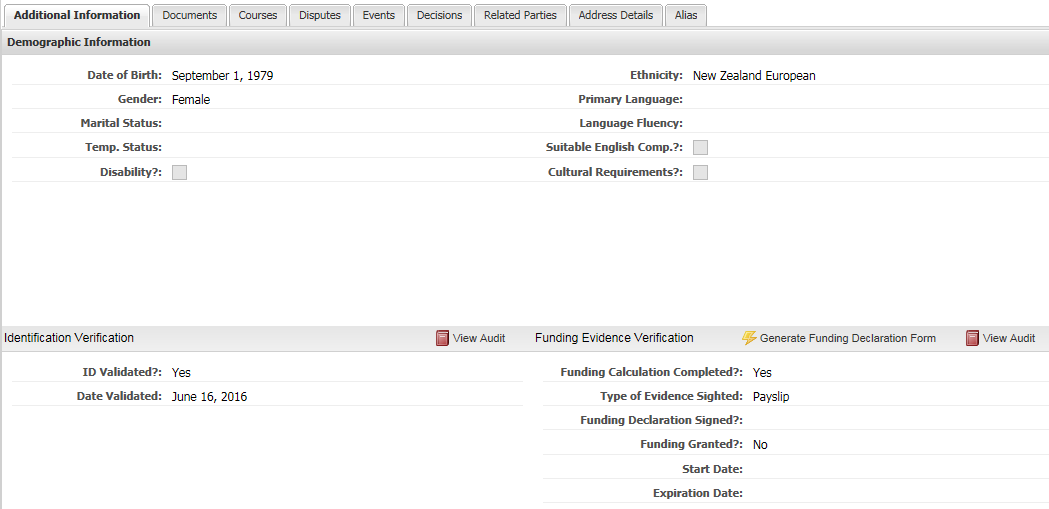

Generate the form from within the party record. Click on the Generate Funding Declaration Form icon in the party record.

-

Complete the form with the party and then you and the party must both sign the form.

-

What next?

Once you have completed the funding declaration form, you must update the party record.

The funding declaration form explained

Section 1 – Applicant Personal Details

This will be pre-populated with information already entered into RMS (or if a blank form has been generated, you will need to complete this section).

Key point!

A dependant is:

- a husband, wife, or partner who is not earning

- a child or children who rely on your client for financial support whether or not they live together. This may also include their partner’s children if they are regularly making payments for them.

A child will only be considered dependent if it is under 19 years of age. Children with student allowances or other benefits are not considered dependent.

Section 2 – Applicant Eligibility Details

Section 2 asks an applicant to fill in their estimated annual income (includes wages or salary as well as any benefits, interest, or income received from a trust and will be estimated based on earnings in the past three months). They need to tick which one of the financial eligibility criteria applies to them.

Option 1

‘I have received a grant of Civil or Family Legal Aid within the past 12 months and my financial circumstances have not changed since I was approved for this grant of Legal Aid’.

- All Legal Aid clients must notify the Ministry if their income or disposable capital increases.

- They need to be aware that this increase may affect their eligibility for Legal Aid (s25 of the Legal Services Act 2011).

- Where an applicant is in receipt of Legal Aid, they have continued eligibility for both Legal Aid and the Family Legal Advice Service while that grant of Legal Aid is active, unless their circumstances change.

Option 2

‘My estimated annual income before tax and other deductions is below the funding income threshold’.

Option 3

‘My income has changed in the past 3 months, and is below the funding income threshold’.

The applicant will need to explain how their income has changed in the past three months. For example, the applicant may no longer be working or working reduced hours to assist with childcare arrangements.

Section 3 – Income Thresholds and Section 4 - Privacy Statement for Applicant

Sections 3 and 4 provide information about financial eligibility thresholds for accessing this service free of charge, and a copy of the Privacy Statement.

Section 5 – Applicant Declaration and Section 6 – Applicant Checklist

- The Applicant Checklist in RMS provides a list of preferred proofs of income. You can accept other forms of proof of income, as long as you are satisfied that the party is who they say they are and their income information is accurate.

- You must explain to the party that you are collecting and recording their evidence of income to meet audit obligations and may be required to send copies of this material to the Ministry of Justice.

- A party must give consent for you to retain copies of their proof of income. You can use the Privacy Statement available in RMS and refer to this in the Applicant Checklist to help explain this consent requirement.

Section 7 - Service Provider Confirmation and Section 8 – Service Provider Checklist (for office use only)

Once a party has signed the funding declaration form, you must complete the form by confirming and certifying that:

- your party qualifies for access to funded services

- you have viewed the party’s proof of funding eligibility and retained a copy.

The funding eligibility assessment can be performed by a fully funded FDR provider or their delegate(s).

Section 9 – Resolution Management System (for office use only)

You, or your delegate, must complete section 9 once you have entered the party’s details in RMS.

- The expiration date is 12 months after the funding eligibility assessment is carried out.

- After this date, you must re-assess the party’s financial eligibility before they can receive any further funded out-of-court services.